Recovery economics have shifted, not because traditional methods fail, but because traditional approaches no longer scale linearly with rising delinquency volumes.

In 2026, both collection costs and compliance risk surged as delinquencies climbed across unsecured consumer credit in North America and select emerging markets, underscoring why businesses are comparing the efficiency, scalability, and compliance benefits of AI-powered collections against conventional models.

Collection costs are rising, driven by increasing labor demands and declining contact rates. Fully loaded fees range from 20% to 50% for many traditional models. The conventional approach, more letters, agents, and calls, is proving ineffective, as younger consumers ignore unknown numbers and Regulation F mandates omnichannel engagement, squeezing margins.

AI debt collection and recovery software closes this gap by decoupling recovery from headcount, creating a structural shift in portfolio scaling. For decision-makers, the focus is no longer on AI or traditional methods; it’s on how to harness AI to improve efficiency, reduce costs, and capture lost value.

Why This Comparison Matters Now

The debt collection process is a key pain point for many businesses as both B2B and consumer repayments come under pressure due to factors like rising inflation rates, higher cost of living, higher revolving credit utilization, and normalization of delinquency rates.

With tightening regulatory oversight, debt buyers and lenders are facing growing pressure to improve debt collection recovery rates through modernised debt collection practices.

- Regulation F has fundamentally changed the contact strategy by imposing frequency caps, requiring channel transparency, and mandating documented consumer-preference logic.

- Borrowers increasingly expect asynchronous engagement via SMS, WhatsApp, chat, and email, not the traditional focus on repeated phone calls.

- FDCPA/TCPA litigation and complaints are rising, increasing the cost of human error as well as making the TCPA the biggest headwind for the industry.

- Agent availability and retention are shrinking, especially post-pandemic.

- Portfolio margins are tightening, making inefficient traditional collection workflows financially unsustainable.

While traditional collections scale linearly, AI introduces operating leverage, enabling incremental volume to be absorbed at minimal marginal cost, changing how capacity planning works at scale.

The next logical step is to use customized AI debt-collection software to improve debt-collection practices.

What is Traditional Debt Collection

The traditional debt collection process relies on collectors calling debtors from their collection lists and sending letters and emails to their listed addresses. This process is usually laborious, can be inefficient in a digitized consumer base, and runs up high costs per bad account.

We’ve found that the average inbound agent utilization rates are 40-45% for inbound, while the figures are even lower for outbound agents.

There is usually little room to assess why an account is going bad or how effective these collection measures are. With a skilled team, turnaround is often strong because the collector can assess clients and work out mutually beneficial solutions.

Human judgment and empathy should only be utilized for handling high-ticket accounts and hardship cases. In large-scale consumer portfolios, cost and staffing concerns, such as team tenure and supervisor quality, create inefficiencies.

What is AI-Powered Debt Collection

AI-powered collections systems apply data-driven decisioning to determine who to contact, when to engage, through which channel, and with what message, at scale. The collection process is optimized by customized strategies across different customer categories.

AI-powered communication agents reach out to clients through their preferred communication channels like SMS, chat, or call, and facilitate resolving the issue where possible. They automate repetitive workflows and handle thousands of accounts and conversations at scale so that human expertise is preserved only for high-impact decisions.

To ensure compliance, all the regulatory requirements can be embedded in code and applied in real-time across all interactions.

According to Zipdo, over 70% of debt collection agencies now use AI-powered tools.

The Core Technologies Driving AI Collections

Machine Learning Algorithms

Machine learning enables collections leaders to prioritize accounts based on repayment likelihood and timing. By continuously analyzing portfolio performance and borrower behavior, these models support tiered strategies that allocate effort to deliver the highest return, improving recovery outcomes without increasing operational complexity.

Natural Language Processing

This technology gives collections leaders the ability to scale customer conversations across both digital and voice channels while maintaining consistency, context, and regulatory discipline. It monitors interactions in real time to detect off-script behavior or potential compliance risk, reducing reliance on manual QA and post-call reviews.

Predictive Analytics

Predictive analytics uses historical data and machine learning to forecast a debtor’s likelihood of repayment and identify the right channel, timing, and messaging for maximum chances of recovery. This replaces the uniform outreach of traditional methods with targeted engagement, improving contact efficiency and conversion without increasing volume.

Process Automation

Financial institutions can automate the labor-intensive and repetitive tasks from the collections workflow, such as data entry, payment processing, and account updates. This enables leadership teams to scale portfolio volume without proportional increases in staffing, redirecting human effort toward complex or sensitive cases.

Generative AI And Compliance Engines

Generative AI modules ensure consistent, personalized repayment communications at scale. This could be anything from repayment proposals, follow-up emails, and call scripts, while embedded compliance engines enforce regulatory requirements across every interaction. Together, they allow organizations to expand digital outreach without increasing compliance risk or oversight costs.

Side-by-Side Performance Comparison

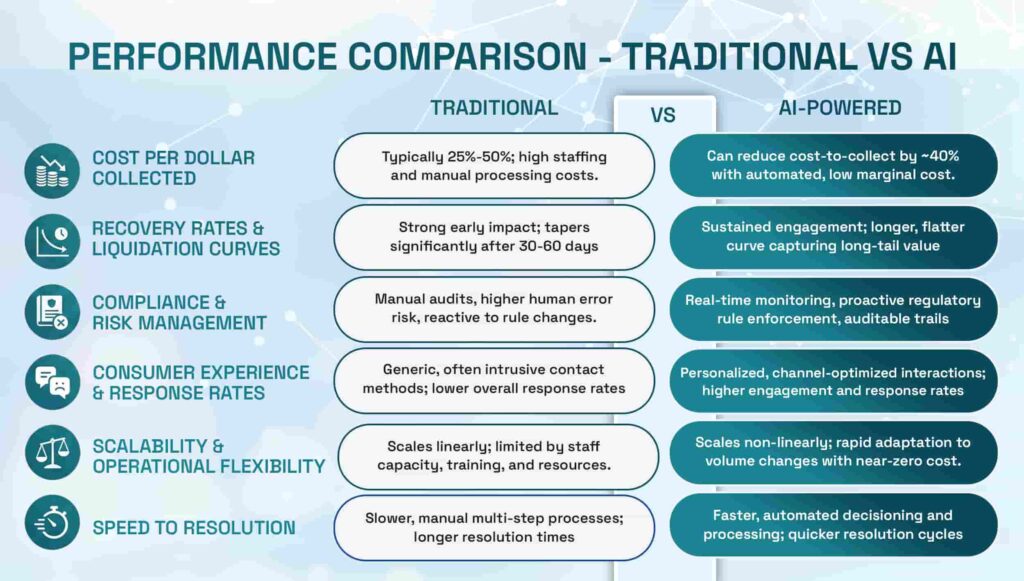

Traditional and AI-powered debt collection methods differ significantly in process, cost structure, and scalability, and a comparison could be unfair across different metrics.

Cost Per Dollar Collected

Traditional: Due to the manual and time-consuming nature of traditional debt collection methods, the average collection cost per account can range from $15 to $25 or about 25% to 50% of the collected amount charged by many third-party agencies handling consumer debt.

Higher staffing needs, supervision, training, and operational costs all add up.

AI Debt Collection: While the one-time deployment cost may seem high, it usually means thousands of accounts can be processed at negligible marginal cost. In addition, the AI automation can reduce the cost to collect by up to 40% in early-stage delinquency under specific portfolio conditions.

AI helps to break the traditional direct relationship between portfolio volumes and staffing costs. An additional 10,000 accounts will not require new seats, training, or oversight. There will be almost zero increase in marginal costs.

Recovery Rates and Liquidation Curves

Traditional: In traditional debt collection methods, the recovery curves taper off after the first 30-60 days, and it is usually effective in personalized segments, where human persuasion makes a difference.

AI Debt Collection: AI’s persistent, personalized engagement can improve recovery rates over longer periods, especially in digitally engaged portfolios. This reshapes the liquidation curve, as while AI sustains engagement over the 120-180 days, for most early- and mid-stage consumer portfolios, especially with high digital engagement preference, as many consumers often prefer continuing with AI rather than transferring to human agents.

This helps to capture value that was historically treated as lost and sustained engagement beyond day 90 can materially improve portfolio IRR, even when headline recovery percentages appear modest.

| Dimension | Traditional | AI-Powered |

| Cost per Dollar Collected | Typically 25%–50%, rising directly with volume. | Can lower cost-to-collect by ~40% in early-stage portfolios, depending on where their current teams are |

| Cost Scalability | Scales linearly | Scales non-linearly |

| Marginal Cost of Growth | Each incremental account adds a recurring operating cost. | Incremental volume carries near-zero marginal cost post-deployment. |

| Recovery Pattern | Strong early impact, typically tapering after 30–60 days. | Sustained engagement extends recoveries to 120–180 days. |

| Liquidation Curve | Front-loaded with rapid decay, leaving long-tail value uneconomical. | Longer, flatter curve continues extracting long-tail value. |

| Strategic Implication | Higher delinquency usually means higher costs and margin pressure. | Higher delinquency does not automatically increase costs, creating operating leverage. |

Compliance and Risk Management

Traditional: In this debt collection method, human-led collections are structurally exposed to judgment variability. Differences in interpretation, tone, timing, and documentation across agents and teams can compound at scale, increasing the probability of compliance drift even within otherwise well-governed operations.

AI Debt Collection offers compliance engines and rules-based operations, with a consistent application of policies. There are usually seven layers of guardrails for AI collections softwares, with each layer catching different types of non-compliant behavior. This provides a comprehensive audit trail for regulators.

Primary risks shift from human inconsistency to model governance, rule configuration, and monitoring discipline, all of which can be proactively audited and corrected centrally. Kompato AI performs automated quality review (for language, tone, compliance rules) and deterministically provides consistent coverage across 100% of interactions.

Consumer Experience and Response Rates

Traditional: In this debt collection method, live communications can be misinterpreted or become heated, and many consumers complain of recovery agents using aggressive tones.

AI Debt Collection reduces friction by shifting collections away from real-time interactions that can trigger stress, avoidance, and defensiveness. Instead, it uses a self-directed customer path designed through sentiment analysis tools. This makes the process feel more like a routine bill payment than a recovery conversation.

Scalability and Operational Flexibility

Traditional: In traditional debt collection methods, many teams cannot grow as they are restricted due to budgets, space, and availability limitations. In case of expansion, hiring and training personnel can take up valuable time and resources.

AI Debt Collection software scales more linearly, as rising debt portfolio sizes do not require more resources. This makes AI more suitable for companies facing cyclical or sudden rises in delinquencies.

Speed to Resolution

Traditional: Resolutions under these debt collection methods are highly dependent on the agent’s experience, training, and building a connection with the customer.

AI Debt Collection: Using a mix of real-time communication scripts, intelligent response engines, and other tools, AI can quickly assess a customer’s situation, present tailored repayment options, and resolve routine issues in minutes.

When paired with integrated digital payment rails, like mobile wallets, ACH, or instant bank transfers, these systems reduce friction, minimize follow-ups, and accelerate the time-to-resolution across high-volume portfolios.

The Real-World Impact on Different Portfolio Types

While there are always commonalities in businesses and segments, there are always nuances that need to be catered to for optimum results. The right mix of AI tools and traditional debt collection expertise can lead to better results.

Fresh Charge-Offs and Early-Stage Delinquency

Early-stage delinquency is usually the under 30-day category. Most customers are willing to engage and opt for customized settlement options.

AI tools excel in this category as they can engage on multiple channels simultaneously, and many offer self-service options, which can be a success factor. With an omnichannel digital strategy, financial institutions are achieving recovery rates by 40%.

Aged Debt and Distressed Portfolios

Where human judgment and empathy are needed, the traditional approach used to work better as skilled agents could help customers work out a payment option that fits their income flows.

However, in 2026, AI has reached functional parity for many portfolios by handling structured settlements and routing only genuinely complex cases to experienced agents. Many modern solutions, like Kompato AI, offer customized payment plans based on the debtor’s financial situation, payment behaviour, and demographics.

High-Balance vs Low-Balance Accounts

If your business is based on high volume and low balance accounts, updating your debt collection technology makes the most business sense, as having a human collection team will be too costly.

In medium and high balance accounts, while human intervention is still needed, AI tools are increasingly effective in working out payment options, ensuring compliance and regulatory parameters are being met.

When AI and Human Expertise Work Better Together

Hybrid collections are not a compromise, but an orchestration model, where AI governs flow and humans intervene for exception handling.

AI will handle the volumes, repetition, compliance, and early-stage interaction, while human agents will shift to high-leverage activities like negotiation, empathy, risk decisions, and exception management.

The real question now is how to design the right point for efficient handoff, not whether humans should remain involved.

Why Hybrid Often Outperforms Either Approach Alone

Hybrid is no longer a compromise; it is the operating model that defines modern collections.

AI sets the pace and volume, while humans unlock the last-mile value.

Accounts enrolled for debt settlement, which could be up to 30% of the average portfolio, are highly profitable when handled by specialist agents. Our experience shows that two dedicated human agents can generate 30-35% of total agency revenue on these accounts. This shows just how effective the strategic allocation of human expertise to high-value segments can be.

AI tools offer scalability, speed, and accuracy, and human experts bring in core human skills like empathy, discretion, and out-of-the-box thinking to resolve complicated situations. This lets businesses achieve higher liquidation rates at significantly lower costs.

What AI Should Handle

Debt collection and recovery software should offer collection services with no restrictions on customer count. Success depends on data accuracy, clear segmentation, payment integration, and organizational readiness.

Combined with compliance oversight and measurable ROI, AI becomes a strategic lever for faster, lower-cost, and more reliable debt recovery. There is no question that some consumers feel more comfortable discussing their debt issues with AI than with humans due to a reduced shame barrier.

For the most effective utilization, AI tools should handle repetitive bulk outreach tasks like:

- Initial contact attempts

- Channel preference determination

- Reminder cycles

- Payment link delivery

- Basic Q&A and customer objections

What Humans Should Handle

Human resources should step into the picture where the following complex issues need to be addressed:

- Hardship and vulnerable consumers

- Where legal escalation is required

- Complex settlements

- Disputes and risk-sensitive cases

Creating Seamless Handoffs

The path forward is clear, with a smooth handover between AI software and human debt collections helping businesses utilize the best of both aspects. The debt collection and recovery software identifies the stage at which the human debt collectors need to step in and offers a contextual background for continuity.

The impact of regulatory concerns on hybrid model design is significant, as this is a major consideration in model designing, even more important than performance optimization. Inbound and outbound specifics also play a role.

TCPA consent requirements make outbound AI riskier than inbound, and many agencies often start with inbound AI, where consent is implicit due to consumer-initiated contact.

A Framework To Make Your Decision

Getting any effective debt collection method up and running is not a simple process. Customer care leaders need to ensure the efficient application of the gen AI ecosystem. Proceeding in small, manageable steps helps a lot.

Key Questions to Ask

For an initial assessment, financial institutions should ask the key questions, such as:

- Do we have enough data, and is it ready to use?

- What are our key portfolio volumes?

- What is the acceptable unit recovery cost cap?

- Are the governance, compliance, and ethics clearly marked out?

- How big is the existing agent workforce?

- Have we defined our measurable ROI factors?

- Do our consumers prefer digital engagement?

- What are the compliance risk pain points?

These diagnostic questions align with how CFOs evaluate capital allocation: marginal cost, risk exposure, and scalability, not just operational convenience. This is why AI decisions are now happening in the boardroom.

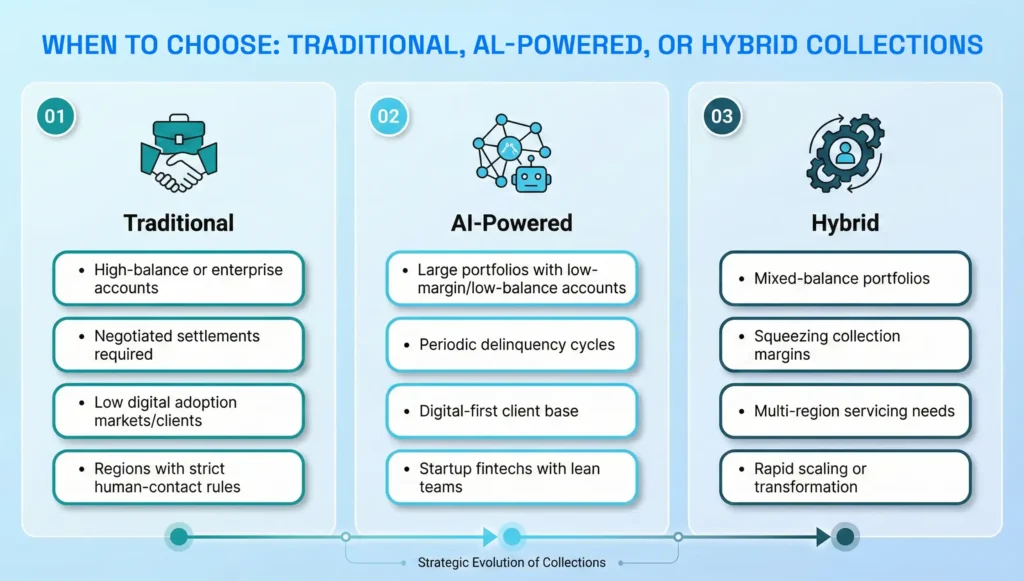

When to Choose Traditional Methods

For businesses with low volumes and highly customized client interactions, traditional debt collection methods may generally be more effective. In addition, the following factors prove to make debt collection software less effective.

- High-balance or enterprise accounts

- Situations requiring negotiated settlements

- Markets/ clients with low digital adoption

- Regions with strict human-contact legal requirements

When to Choose AI-Powered Collections

Just as low-volume and high-ticket clients are more suited for traditional debt collection methods, high-volume and low-ticket clients are the perfect use case for AI-powered debt collection technology.

If you have:

- Large portfolios with low-margin or low-balance accounts

- Periodic delinquency cycles

- A client base that is comfortable with digital channels

- Startup fintech lenders working with lean teams in tech friendly market

When to Implement a Hybrid Approach

A mix of AI and traditional debt collection methods will work for businesses that have:

- Mixed-balance portfolios

- Squeezing collection margins

- Multi-region servicing needs

- Organizations scaling rapidly

- Firms in transformation mode

How Kompato Delivers on All Three Approaches

Kompato is designed to support AI-first, human-led, and hybrid operating models within a single orchestration layer.

Instead of forcing businesses to choose between automation and agents, Kompato operationalizes the entire spectrum from AI-first to human-led, allowing organizations to deploy the optimal mix for their specific portfolio needs.

Whether an organization needs AI-first automation, human-led recovery with AI assist, or a true hybrid model, Kompato orchestrates the entire workflow through:

- AI-first automation that handles up to 98% of routine borrower contacts for most portfolios

- Human enablement tools that make agents more effective, not obsolete

- Analytics that identify which strategies outperform and why.

- Assessment and execution of shared context across conversations and voice, SMS, email, and chat channels

- Decision engines that route accounts to the most effective channel: bot, digital, or human

The net result:

Lower costs per collected dollar, longer-tail liquidation uplift, and dramatically reduced compliance variability.

Final Thoughts on AI vs Traditional Debt Collection Methods

The real competitive advantage is not AI alone; it is orchestrating the optimum blend of AI and human skills.

Organizations that treat AI as a strategic partner to human expertise, and not a bolt-on tool, will widen the gap in recovery performance in 2026 and beyond.

The firms that pull ahead will be those that integrate the latest technology and talent in a single system instead of treating them as mutually exclusive tools.

Firms that use debt collection methods and techniques that successfully align AI scale with human judgment will define recovery performance over the next decade. The human element is never going away, and human skills like negotiation, empathy, and relationship-based recovery elements will remain relevant.

Frequently Asked Questions

No, there are upfront setup costs, but the long-term cost is significantly lower than traditional debt collection methods.

AI will not replace human collectors; it will just change what they do and how they do it.

The high-volume and low-margin market will shift towards AI-based collections.

Human teams will be smaller and more specialized. They will focus on negotiation and resolution of outlier and edge cases, while intelligent AI tools handle the routine collections.

The timeline can range from as low as 11 weeks to 6 months. The largest risk is waiting too long to start while early adopters pull ahead.

The lift will vary across industries, but many lenders experience between 10%-30% improvement in early-stage recoveries. Outcomes depend heavily on portfolio mix, data quality, channel consent coverage, and servicing discipline.

The major benefit of this method is its strong focus on compliance parameters. These need to be configured into the system at the implementation stage.

If the complex settlements are structured and common enough to form a pattern that the algorithm can assess, AI can handle them; otherwise, settlement and hardship cases are more efficiently handled by human agents.

If the system is configured properly, the AI tool will escalate the account with contextual details to a human agent for the next stage of resolution.

Surprisingly, debtors respond better to the AI-first and non-confrontational approach that AI collection adopts. There is less friction and embarrassment from receiving a call from an automated caller, and therefore, there are usually better results. This is making them more effective debt collection methods.

Kompato usually resolves over 98% of its conversations without escalation to a human agent.

AI excels in low- to medium-value, high-volume portfolios, where traditional collection techniques are too costly and slow. These accounts are usually digitally engaged and allow AI to manage outreach, prioritize actions, and boost recoveries at scale. High-value or complex accounts may still need human judgment, but AI handles the majority efficiently and profitably.

Yes, right now, the hybrid approach is the best option where AI drives routine, early-stage interactions while humans focus on exceptions, negotiations, and high-value accounts. This approach delivers results that neither AI nor humans can achieve alone.