In the evolving financial landscape of 2026, debt collection technology extends beyond recovering overdue balances. As debt increases, repayments become more unpredictable. Lenders, debt buyers, and collection agencies are trying to generate revenue while remaining compliant and continuing to build their longer-term consumer relationships.

Collection agencies typically recover only 20-30% of unpaid debts on average due to ineffective outreach, poor timing, and misaligned communication strategies. Traditional methods do not address the current needs of the market effectively.

Financial institutions are experiencing a major transformation through AI debt collection workflows. This new approach focuses on a more empathic and compliant way of communicating with consumers. Ultimately, this results in lenders and collection agencies recovering a greater percentage of their outstanding debt while simultaneously improving the way they treat their customers.

Let us share our expert thoughts on how AI in debt collection is transforming the industry based on our years of experience.

Why AI Matters in Modern Debt Collection (Beyond Automation)

Based on our experience, modern debt collection is about eliminating guesswork and leveraging data to identify trends and make contextual, intelligent, compliant, and data-driven decisions at scale. Using AI in debt collection can process thousands of variables at once, like payment history, behavioural shifts, timing patterns, and external indicators, to do far more than prioritizing outreach.

AI continuously learns from outcomes to refine strategies, reduce unnecessary contact, prevent compliance violations, lower operational costs, and improve recovery rates.

AI intelligently determines who to engage, when to engage, how to engage, and when not to engage at all.

For example, by leveraging AI debt collection technology, lenders can identify a previously reliable payer facing temporary hardship and recommend a tailored payment plan rather than aggressive outreach.

According to industry insights, AI is used 57% in predicting and segmenting accounts and 56% in facilitating self-service and virtual negotiations.

How AI in Debt Collection Improves the Debtor Experience

From Confrontation to Collaboration

AI-powered automated debt collection technology helps lenders and collection agencies minimize adversarial interactions by analyzing the consumer’s account history, payment behaviour, and current financial situations. Then it recommends a tailored and empathetic outreach plan that maintains trust and long-term customer relationships.

Research indicates that AI technologies increased collections by up to 30% and reduced collection costs by up to 40%.

Personalized Communication at Scale

Instead of treating every consumer the same way, AI debt collection technology adapts the tone, contact times, and communication channel based on their profile, payment behaviour, and engagement history. Another key advantage is that AI remembers past interactions across channels through its unified memory. Across large-scale collections operations, we consistently see that this approach prevents repetitive interactions and boosts responsiveness and customer satisfaction.

24/7 Self-Service Payment Options

AI-powered portals and chatbots offer debtors personalized ways to view balances, schedule payments, or adjust plans at any time without contacting a human agent. This accessibility improves convenience, reduces bottlenecks, and accelerates repayment.

Reduced Stress Through Transparency

Real-time notifications, clear payment options, and AI-guided payment plans make repayment predictable and understandable.

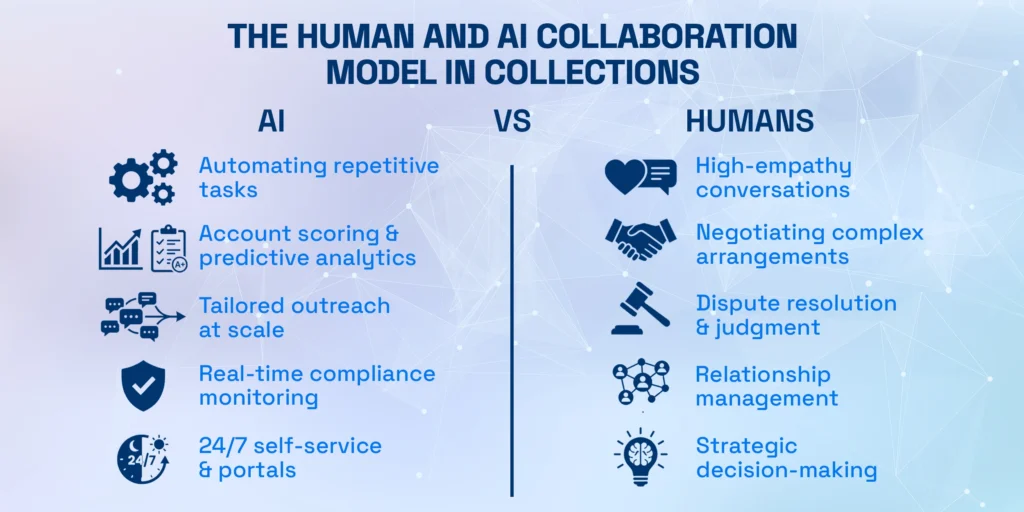

The Human and AI Collaboration Model in Collections

What AI Handles Best

AI excels at automating repetitive processes such as payment reminders, account scoring, and outreach to consumers in early stages of debt. Artificial Intelligence in debt collection can also analyze large datasets quickly, predict customer payment likelihood, and develop tailored repayment plans in a compliant and accurate manner.

What Human Collectors Do Best

It’s undeniable that human collectors provide irreplaceable emotional and contextual understanding for tasks such as high-empathy conversations, negotiating complex payment arrangements, resolving disputes, and handling sensitive accounts that require judgment, discretion, and relationship management. This is why we design our AI agents with a human-in-the-loop protocol, allowing human expertise to guide complex and sensitive interactions wherever necessary.

Seamless Handoffs Between AI and Humans

Through years of experience in this finance industry, we have concluded that human intelligence combined with AI offers the best of both worlds. For example, when a case requires human intervention, the AI agent in automated debt collection software flags the priority and escalates the issue to a human representative to support better decision-making.

In our case, Kompato AI handles 96%+ of inquiries without human escalation, but instant escalation is available if the consumer prefers it.

Enhancing Human Agents, Not Replacing Them

AI-powered automated debt collection software, such as Kompato AI, serves as an intelligence assistant for human agents, reducing their workload and enabling data-driven decisions through predictive analytics. Hence, these agents can focus on more strategic work that requires human intelligence.

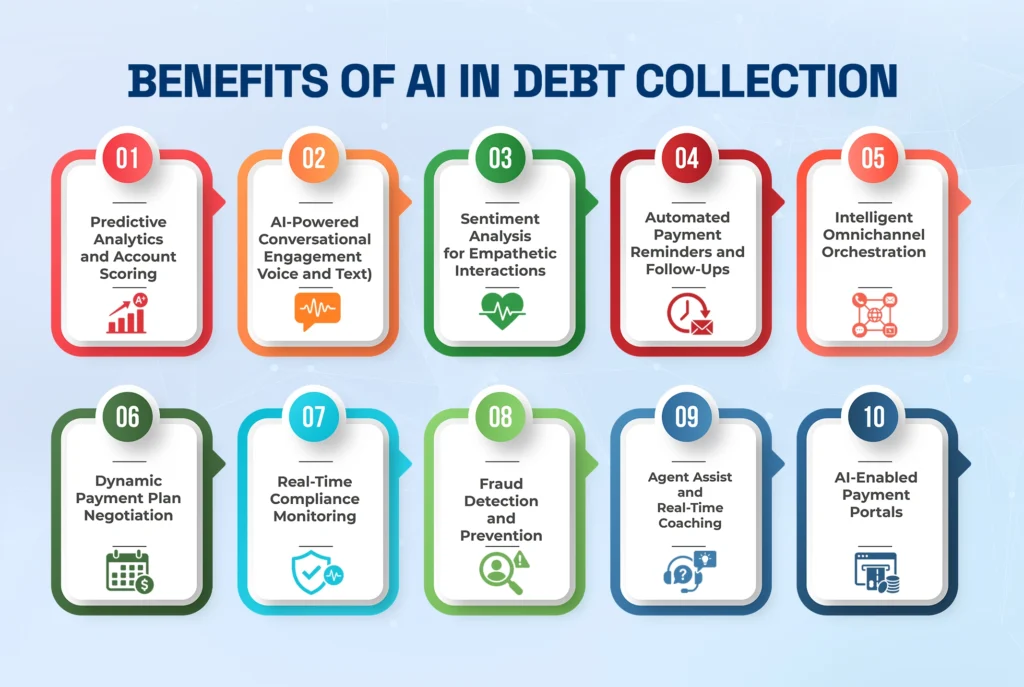

Benefits of AI in Debt Collection

Predictive Analytics and Account Scoring

Leveraging machine learning models, banks, lenders, and debt buyers can replace intuition with evidence. AI can analyze historical customer data and current trends, including payment behaviour, customer profiles, engagement patterns, seasonal increases in defaults, and automatically score accounts based on repayment likelihood.

According to Zipdo, AI-driven predictive analytics can forecast debt repayment likelihood with 80% accuracy.

AI-Powered Conversational Engagement (Voice and Text)

Static scripts fail when conversations become personal. AI debt collection agents offer tailored dialogue, with the ability to answer questions, adapt tone, and guide debtors toward resolution across voice and text channels.

One of the main benefits of conversational AI for debt collection is that many early-stage issues can now be resolved entirely through AI-led conversations, without escalating to human agents.

Our case study revealed that with Kompato AI, only 3.6% of AI agent led voice conversations require escalation to a human agent.

Sentiment Analysis for Empathetic Interactions

Through Natural Language Processing (NLP), AI can analyze the customer’s emotional state (e.g., anxious, hesitant, or frustrated) in real-time and address the customer using an empathetic and personalized approach.

When escalation is needed, the AI notifies a human agent to step in—ensuring empathy is preserved where relationship strength matters most.

Automated Payment Reminders and Follow-Ups

Timing matters as much as messaging. One pattern we see repeatedly is that recoveries don’t taper after early outreach; they continue to grow. Leveraging AI, automated debt collection software learns when a debtor is most likely to engage and delivers SMS, email, and AI calls accordingly. This strategy minimizes ignored messages and increases response and recovery rates.

Intelligent Omnichannel Orchestration

Most collection organizations use multiple channels, but few use them intelligently. AI-driven automated debt collection technology uses integrated data and past behaviour to deliver the right message to the right channel.

Our data reveals new efficiency gains through AI’s persistent, low-cost, multichannel model. Let’s say a debtor engages via email but avoids calls; AI dynamically shifts outreach to email while preserving context from prior outreach and responses.

Dynamic Payment Plan Negotiation

AI in the collections industry replaces one-size-fits-all strategies with flexible and dynamic payment plans that consumers can realistically complete based on their financial situation, payment history, and spending habits.

Real-Time Compliance Monitoring

Compliance failures often happen mid-conversation, not after the fact. AI-driven automated debt collection software continuously monitors disclosures, language, contact timing, and contact rules in real time to prevent violations of FDCPA, TCPA, and CFPB regulations. Hence, compliance becomes proactive and not reactive.

Fraud Detection and Prevention

By leveraging machine learning, predictive analytics, and NLP, debt collection agencies can identify anomalies such as identity mismatches, unusual payment behaviour, sudden drop in income, or account manipulation attempts in real-time.

This proactive approach flags risks early, prevents fraudulent activity, assesses debtor risk, and secures sensitive data while protecting legitimate customers.

Agent Assist and Real-Time Coaching

One of the best examples of agentic AI in debt collection is during live interactions, where AI facilitates the human agent with recommended responses, next-best actions, and compliance-safe language. After the call, AI can automatically generate call summaries and update CRM records with relevant details – dramatically reducing post-call work for the human agent.

Of course, performance only matters if it’s compliant. We use language models to polish phrasing, but we never share data or transcripts with those models.

AI-Enabled Payment Portals

AI-powered automated debt collection technology turns static portals into intelligent decision tools. For example, a debtor who has previously paid in lump sums may be shown a discounted pay-off option, while someone with irregular income is guided toward a short-term installment plan with flexible dates.

In another scenario where a payment is missed, the portal can proactively suggest an adjusted plan before the account escalates.

Ensuring Regulatory Compliance with AI-Powered Automated Debt Collection Software

How AI Ensures FCDPA Compliance

Over the years of working with regulated financial institutions, we’ve seen that FCDPA violations often occur when agents use language that resembles threats or harassment, or contact too frequently or at inconvenient times (before 8 a.m. or after 9 p.m.).

AI debt collection technology learns predefined FCDPA contact rules and ensures that every outreach adheres to contact frequency limits, approved language, and timing restrictions (based on the customer’s time zone) across channels.

UDAAP Compliance Through Empathetic AI Engagement

UDAAP risk increases when consumers feel pressured, misled, or confused. If a debtor shows signs of distress (in SMS or calls), AI analyzes their sentiments in real time and avoids pushing them toward aggressive repayment demands. AI will guide with empathy toward clear, manageable solutions that resolve complaints while adhering to UDAAP regulatory requirements.

TCPA Compliance and Prior Express Consent Management

AI centralizes consent data across channels and enforces it in real time. Before any automated outreach, AI tracks the consumer consent and preferences to minimize human error and legal risk.

Imagine a debtor revokes SMS consent or limits call permissions, AI immediately updates outreach eligibility, and no follow-up message slips through SMS, nor does the debtor get an automated call beyond that limit.

State-Specific Compliance Rules

Beyond FCDPA, AI platforms have state-level rules hardcoded in their system based on debtor location and account type and enforce them in real time to build trust and avoid compliance issues, no matter where they’re located. This means a debtor in California and one in Florida are governed by entirely different compliance frameworks, without human agents needing to manually track the differences.

Complete Audit Trails and Documentation

AI logs every interaction, rule applied, consent check, and escalation with timestamps and context. So when regulators ask why a decision was made, AI provides defensible and transparent answers by highlighting which factors were most influential in a decision. This is what we call “Explainability in AI” or XAI.

AI Implementation by Organizational Maturity

Level 1 – Starting Out (Basic Automation)

Based on our practical experience, if your organization is just getting started with AI, begin by automating low-complexity tasks to increase collector throughput and reduce repetitive work. Typical capabilities at this stage include RAG-enabled knowledge bases to enable agents and assistants to retrieve precise policy/account answers, speech-to-text transcriptions, power dialers, and TCNs to increase contact velocity.

- To start implementing AI, begin by identifying repetitive rule-based tasks such as reminders, status updates, and payment confirmation that require no or minimal human input.

- Then deploy AI in a way that ensures compliance and handles these tasks through automation without disrupting existing workflows.

- Free your human agents to focus on more strategic work.

- Track early indicators such as weekly hours saved, reduced resolution times, and lower cost per account.

Level 2 – Scaling Up (Advanced Analytics)

As financial institutions mature and learn to leverage the quality and quantity of their data, they can apply predictive analytics to identify specific account segments that deliver the greatest results. Teams work with clarity by prioritizing accounts, optimizing channels, and tailoring communication based on likelihood to resolve.

Level 3 – Full Transformation (AI-First Operations)

Once financial organizations have fully transformed into AI-first organizations, decision-making relies on AI’s ability to intelligently integrate all business processes and resources and use data to support the customer experience.

At this stage, AI orchestrates channels, enforces compliance in real time, supports agents during live interactions, and adapts strategies continuously based on outcomes. Human collectors focus almost entirely on complex, high-empathy cases.

Overcoming AI Adoption Challenges

Change Management and Team Buy-In

The introduction of AI into debt collection workflows may create fear among collection teams, who may perceive it as a threat to their jobs. In order to alleviate this fear and gain employees’ buy-in, leaders need to communicate that AI should be viewed as an empowering tool, not a replacement for existing work processes.

Data Readiness and Quality

It’s a proven fact that the quality of AI outcomes is as good as the data it is trained on. The vast majority of the data available to organizations has been accumulated over time from a variety of sources. Also, real-world data is often fragmented, contains missing values, and is inconsistent.

Financial institutions must first invest time and money in improving data quality and making it usable for AI models through techniques such as data standardization, normalization, deduplication, and entity resolution.

Integration with Legacy Systems

Because most debt collection software was developed before the rise of AI, it cannot be easily replaced with AI-based systems without incurring significant risks and costs for the financial organization.

As a result, the logical solution is to integrate AI into an organization’s existing CRM, dialer, and payment systems via APIs and other established integration methods, without disrupting existing workflows.

Measuring and Proving ROI

For most financial executives, ROI is the deciding factor in whether to adopt AI debt collection technology. Did you know that 60% of collections firms consider AI tools? Before deployment, financial institutions must define tangible factors to evaluate AI impact, such as:

- Recovery rate lift

- Cost per resolution

- Average time to resolutions

- Complaint volume

- Agent productivity

- Weekly hours saved

- Compliance incidents.

Compliance and Risk Concerns

A common concern is that AI can introduce new risks instead of minimizing them. This can be true, but only if the AI operates without clear boundaries, transparency, or governance Leading debt collection agencies embed compliance into AI workflows through real-time language monitoring, contact frequency, consent status, and regulatory thresholds, with automated intervention before a violation occurs. Every decision and interaction is logged, traceable, and explainable to reduce ambiguity during audits or disputes.

Kompato: The Complete AI Collections Platform

Since its inception in 2024, Kompato has been transforming debt collection to meet today’s needs by leveraging the combined power of AI, ethics, compliance (FDCPA, TCPA, and F regulations), and automation into a single platform. Unlike traditional automation tools that only streamline collections tasks, with Kompato, debt collection agencies have an end-to-end automated solution that includes predictive analytics tools, tailored client messaging (SMS, email, calls, and portals), and real-time compliance capabilities throughout the entire collections lifecycle.

Debt collection agencies and lenders using Kompato see increased recovery rates, improved customer confidence, and easy scalability, whilst remaining fully integrated with existing CRMs, Dialers, and Payment Systems. We’ve driven liquidation rates 20% higher than those of peer agencies within three months. Only 3.6% of those voice conversations are escalated to a human agent.

Kompato uses advanced Artificial Intelligence technology with human-in-the-loop compliance to offer smarter and more customer-centric collections practices at its core. Human agents using Kompato have the capability to orchestrate multi-channel outreach while managing real-time communication.

The Future of AI in Debt Collection

Emerging AI Capabilities on the Horizon

Looking ahead, we anticipate the next wave of AI in debt collection will go beyond just prediction. AI models will continuously learn from data through live interactions and adjusting outreach strategies mid-conversation rather than between campaigns. AI will also take into account advanced contextual signals like regional employment trends or macro-financial stress indicators to shape intervention strategies before delinquency formally occurs.

At scale, big data architectures will enable cross-portfolio intelligence, where models reason across millions of outcomes to identify which intervention strategies create sustainable repayment versus short-term recovery.

Evolving Regulatory Landscape

Future adoption will likely be shaped by evolving regulatory requirements alongside AI adoption. Organizations should be ready to embrace the advanced explainability, auditability, and fairness in automated decision-making that comes with AI. Future regulatory frameworks are expected to require provable explainability, with system-level visibility into how models weigh data, apply rules, and trigger actions at the individual account level.

Changing Consumer Expectations

Consumers will expect the collections experience to be proactive, predictive, and hyper-personalized. Through cross-ecosystem coordination, AI may connect consented data across banks, lenders, utilities, and subscription services for advanced unified repayment options and notifications that anticipate consumer behaviour across multiple financial touchpoints.

The Competitive Imperative for AI Adoption

Collection organizations that delay adoption will operate with structurally higher costs, slower response cycles, and reduced visibility into risk and performance compared to early-adopting organizations. Leaders will use AI to balance recovery performance with compliance, customer trust, and long-term brand equity.

Getting Started with AI Collections: Your Action Plan

Step 1: Assess Your Current State

We recommend starting with a structured, step-by-step approach to incorporating AI in your debt collection workflows. Begin with a thorough audit of systems, data, workflows, and compliance processes to identify bottlenecks, legacy constraints, data quality gaps, and team readiness. Categorize the tasks where human agents excel and where AI can bring more value. The objective of this assessment is to build a strong foundation that leads to high ROI.

Step 2: Define Success Metrics

We’ve found that defining clear success metrics upfront is critical to evaluating the impact of AI. Establish quantifiable KPIs aligned with strategic goals like recovery rate improvement, cost per account, customer satisfaction, weekly hours saved, compliance adherence, and team productivity.

Step 3: Choose the Right AI Partner

Select a partner who understands the landscape of the debt collection industry and ethical AI deployment. Review their portfolio, ratings, customer reviews, and years of industry experience to determine whether they are a good fit.

Step 4: Start Small, Scale Fast

We often advise our clients to prioritize high-impact workflows first, where AI can lead to early wins fast. Then leverage these early wins to refine models, adjust outreach strategies, and validate assumptions. Once results are proven, expand AI deployment across other operations and departments.

Step 5: Train and Empower Your Team

AI is most effective when human agents understand it, trust it, and leverage it. Provide hands-on training in AI-driven workflows, predictive insights, and escalation protocols. Emphasize that AI augments, not replaces, human judgment.

Final Thoughts on AI in Debt Collection

AI debt-collection technology can seem complex at first, but when applied correctly, it can transform the collection industry in many ways. AI helps lenders predict needs, communicate respectfully, and recover money efficiently. What we’ve learned over years of working in debt collection is that the leaders in this space will not be those who automate the fastest, but those who adopt AI thoughtfully with clear goals, strong governance, and a commitment to ethical use. Platforms like Kompato show that it’s possible to scale performance without sacrificing empathy or regulatory confidence.

Frequently Asked Questions

No. AI is designed to support human collectors rather than replace them. AI improves efficiency in the collection process by handling repetitive, high-volume tasks, allowing human agents to focus on complex accounts, empathetic negotiations, and high-stakes decisions. The most effective collections teams combine AI efficiency with human judgment.

Costs depend on several factors, such as volume of accounts, complexity of workflows, data preparation, integration, customization, and training. Pricing models can be based on subscription-based SaaS, per-account usage, or enterprise licensing.

Visit kompatoai.com to connect with our sales team, experience a live demo and understand our pricing model.

Yes, many modern AI debt collection platforms embed real-time compliance checks, consent tracking, and rule-based controls. They maintain audit trails, escalation workflows, and monitoring to ensure all outreach adheres to FDCPA, TCPA, and other applicable regulations.

Implementation timelines depend on data readiness, workflow complexity, and integration requirements. To give you an estimate based on Kompato’s typical onboarding timeline:

1. Basic automation (simple rule-based workflows, automated reminders, basic scoring): 4–6 weeks

2. Advanced Analytics (predictive scoring, omnichannel orchestration, AI-assisted agent workflows): 8–12 weeks

3. Full AI-First Transformation (Agentic AI, dynamic payment negotiation, real-time compliance, integration across multiple systems): 3–6 months

When implemented with proper planning, AI debt collection solutions can offer significant returns, with expected ROI figures as high as 760%, and typical payback periods of 6 to 18 months. Outcomes include higher recovery per account, fewer outbound attempts, faster resolution, and lower compliance risk.

AI excels at identifying patterns, repayment behavior, and risk indicators to recommend optimal strategies, but complex or high-empathy cases are escalated to humans for better judgment in sensitive situations.

Yes. Most modern AI platforms are designed for integration with legacy CRMs, dialers, and payment systems. This allows organizations to leverage existing infrastructure while adding AI capabilities for scoring, predictive engagement, and compliance without replacing core systems.

High-quality, structured data drives AI performance. Essential inputs include account history, payment behavior, contact attempts, engagement history, consent records, and any previous collection outcomes. The more complete and clean the data, the more accurate predictions and recommendations AI can generate.