Since the emergence of modern AI, its use in debt collection has largely been limited to a basic efficiency layer for tasks like sending reminders, data entry, answering simple customer queries, and automated follow-ups. Useful but limited.

However, the evolving nature of operations and economic pressure raises the capability threshold for AI in collections. Debt buyers and lenders are facing unpredictable delinquency volume, complex regulatory requirements each year, and rising cost-per-dollar collected. At the same time, consumers expect faster contextual responses, flexible repayment options, and high empathetic interactions.

The Global AI for debt collection market size is expected to be worth around 15.9 billion USD by 2034, from 3.34 billion USD in 2024, growing at a CAGR of 16.90%.

Looking ahead, we’ll discuss the future of the debt collection industry with AI over the next two years based on our data-driven forecasts and how forward-thinking financial organizations can position themselves for sustainable, compliant growth.

Why 2026 Marks an Inflection Point for Collections

In 2026, multiple forces are converging at once, which makes it a strong turning point, including stricter regulatory requirements, high cost per dollar collected, and rising delinquent accounts volume. The total addressable market for distressed consumer debt has grown to $167.8B in 2024, up from $115.7B in 2019, reflecting a 7.7% CAGR. Unfortunately, this is not a short-term spike. Delinquency rates stayed elevated and are now being considered as a “new normal”.

In 2026, the fear of missing out (FOMO) is more prominent with AI compared to prior technology waves. When companies see case studies of how AI-powered agencies are achieving better ROI than traditional agencies at scale, their immediate reaction is to shift from learning to pilot.

While microuncertainty remains, the data we presented clearly signals that the future of the debt collection industry in 2026 will enter a phase where AI adoption shifts from a competitive advantage to an operational necessity.

The Delinquency Landscape Reshaping Recovery Strategy

The Federal Reserve data shows delinquencies flattening after rising, but at levels not seen since pre-pandemic. Higher-income households continue to meet obligations, while lower- and middle-income segments face prolonged financial pressure leading to increasingly “K-shaped” recovery curves.

Some key signals that we’re going to present signals that delinquencies may stabilize in 2026, but they’re stabilizing at elevated levels that strain traditional collection operations:

- According to the Federal Reserve Board’s data, credit card serious delinquency is projected to stay around 2.57% through 2026, and 14.1% of outstanding credit card balances were over 30 days past due by early 2025. Student loan delinquencies jumped from 0.5% to 13% in Q1 2025 after reporting resumed.

- According to data from the Consumer Financial Protection Bureau, APRs reached 25.2% for general-purpose cards, 31.3% for private-label (the highest since 2015), and 15% of general-purpose cardholders are making only minimum payments.

- Credit card balances are projected to rise only 2.3% in 2026 (the smallest increase since 2013.

Traditional dialing capacity can’t scale proportionally with volume increases. So the question for collection agencies and debt buyers is, “Can you maintain contact rates and compliance quality at 1.5x or 2x volume with existing operations?”

Geographic Concentration Demands Localized Strategy

Another interesting insight we’ve found is that delinquency rates vary by demographics. Coastal metropolitan regions show higher early-stage defaults on credit cards, while rural communities see sustained arrears in installment lending. This spread between the highest- and lowest-performing regions is wider than at any point in the past decade.

Certain Southern states now lead mortgage stress, with non-current rates approaching 7.5% and serious delinquencies near 1.9%. In contrast, West Coast markets continue to post some of the lowest risk profiles in the country, with 30+ DPD rates below 2% and 90+ DPD hovering around 0.5%.

Now, if debt buyers and lenders apply manual rule-based one-size-fits-all strategies (which they do right now) is no longer effective. Future debt collection strategies will demand AI techniques to analyze and segment a large volume of accounts based on demographics, payment history, income, and engagement patterns to offer tailored plans that consumers can realistically complete.

The Bifurcated Consumer Base Requires Segmented AI

Post-pandemic, the K-shaped reality emerged and continued to 2026. The consumer base has split into three segments.

- The upper-income borrowers ($100K+ income) spend aggressively with low delinquency risk.

- Lower-income households (<$50K income) are increasingly using credit cards to cover daily necessities and face severe financial stress.

- The middle is squeezed by inflation, insurance costs, and utilities.

Applying uniform collection strategies to these three segments makes no sense at all. If collection agencies and debt buyers start applying aggressive tactics indiscriminately, they will face increased disputes and complaints. Similarly, overly lenient approaches toward willing payers also suppress recovery rates.

Unlike humans, AI systems can distinguish distressed consumers who need structured hardship pathways like installment plans, temporary relief, and flexible schedules, vs capable but busy payers who simply require frictionless resolution.

The Labor Economics Forcing the AI Decision

Human labor cannot scale linearly with rising volume and complexity due to its limitations in speed, consistency, and endurance. Call center turnover exceeding 70% annually makes consistent compliance nearly impossible with human-only operations. By the time agents are fully trained, many have left.

We have found some surprising insights that project the future of the debt collection industry, where many jobs will decline, not because of AI displacement but because of industry contraction and operational efficiency requirements:

According to a TransUnion report:

- 73% of U.S. debt collection firms employ fewer than 5 people

- The number of third-party collection firms declined 2.8% to 6,606 in 2023

- 64% of third-party firms agree they must diversify to survive long-term

Also, the Bureau of Labor Statistics projects 9% decline in collection jobs by 2033

But unlike humans, AI can scale linearly with rising volume, complexity, and changing compliance requirements without adding a proportional increase in cost.

Future debt collection strategies will require human agents to focus completely on complex negotiations, hardship cases requiring empathy and judgment, and exception handling.

The Regulatory Landscape Through 2027

The Consumer Financial Protection Bureau has stated that there is no “fancy new technology” carveout from existing debt collection regulations in 2026. AI systems are held to the same standards as human collectors under the FDCPA compliance, UDAAP principles, and state-level consumer protection statutes. Compliance officers have their veto power over technology decisions and demonstrate understanding of their concerns.

Rules Already in Effect (2025)

- The Federal Communications Commission’s Do-Not-Originate blocking requires voice providers to block calls from numbers associated with illegal activity to maintain call hygiene and vendor oversight (December 2025)

- Maryland’s medical debt legislation (HB428, HB1020, HB268) expanded verification and transparency obligations.

- Maine’s Chatbot Disclosure Act now requires clear notice when consumers interact with AI systems.

Coming in 2026

- The FCC’s “Foreign Call Identification” rule will require offshore calls to clearly display foreign origin, directly impacting answer rates for offshore-heavy strategies.

- The FCC’s “Revoke All” consent enforcement (April 2026) applies consent revocation across all lines of business, which makes fragmented consent systems a liability.

- Colorado’s AI Act (June 2026) extends disclosure expectations even to non–high-risk AI deployments to prevent algorithmic discrimination.

- New York City’s digital outreach rules mandate unified consent tracking across SMS, email, and other channels.

Ongoing CFPB Focus

Beyond discrete rules, the CFPB is actively monitoring AI for discrimination, explainability, transparency, and adverse action compliance. Regulators increasingly expect organizations to articulate why an AI system made a decision, and to do so accurately and consistently at scale.

Why AI Becomes Compliance Insurance

Some financial institutions perceive AI as a threat to compliance as it can introduce new risks. However, it can happen only when AI is not implemented correctly in the code with governance, explainability, and ethics.

Human agents dealing with thousands of accounts lead to compliance violations due to human error or oversight, like:

- Third-party disclosure (one of the most common FDCPA violations) due to incorrect identity verification

- Timing violations (calling outside permitted hours)

- Frequency limit breaches (exceeding Reg F’s 7-in-7 rule)

With 70%+ call center turnover, maintaining compliance through training alone is nearly impossible. By the time agents internalize complex state-by-state rules, many have moved on.

That’s where AI tools like Kompato AI eliminate all these issues by embedding “Compliance-as-Code,” which means compliance rules (FDCPA, UDAAP, Regulation F, and state-specific rules) are hard-coded in its system.

Five Predictions for AI Collections Through 2027

Prediction 1 — Consumer-Side AI Enters Negotiations

Many consumers feel uncomfortable negotiating due to a lack of confidence, financial stress, or language barriers. That’s why they are already using AI tools like ChatGPT, Claude, and Gemini as a 24/7 available advisor to draft negotiation scripts, analyze collection messages, and calculate settlement options.

The future of collection anticipates the rise of AI agents on the consumer side that interact directly with collector systems. We predict that by late 2026, sophisticated future debt collectors will encounter consumer AI agents in negotiations.

However, this shift will also create new challenges with raising questions like:

- How do future debt collectors verify that the AI actually represents the consumer?

- Is consumer AI a “third party” under FDCPA, preventing debt disclosure?

From another perspective, this is a blessing in disguise. First-mover platforms that build AI-to-AI protocols like clear authentication, structured offers, and explainable terms gain a competitive advantage. So another prediction we see is that by 2027, protocols for AI-to-AI interaction will emerge as competitive differentiators.

Prediction 2 — Cash-Flow Underwriting Changes Pre-Delinquency Intervention

For decades, the credit risk score was distilled into a three-digit number and updated after a whole month. This debt collection technology trend will be replaced by real-time cash-flow underwriting, which evaluates actual bank transactions, spending behavior, and income stability as they occur. Financial analysts describe this shift as the “death of the static credit score,”

Lenders gain a decisive advantage as they can see actual cash flow, and intervene before delinquency occurs by offering personalized payment plans based on actual cash flow capacity.

By 2027, we forecast leading first-party lenders will reduce charge-off rates measurably through cash-flow-informed early intervention.

Prediction 3 — Industry Consolidation Accelerates Around AI Capability

Roughly 73% of collection firms employ fewer than five people, yet modern compliance, data security, and AI investment now require scale. The number of third-party firms is already shrinking (down 2.8% in 2023). The Bureau of Labor Statistics projects continued job declines through 2033, not because demand is disappearing, but because efficiency requirements are rising.

Jefferson Capital’s IPO signals that sophisticated operators with strong margins, advanced analytics, and scalable AI platforms are now setting the competitive benchmark. That raises expectations across the ecosystem, from clients, regulators, and investors alike.

Since smaller agencies that cannot fund AI infrastructure will face a hard choice: sell, merge, or exit. Their portfolios and client relationships retain value, but their operating models do not. As a result, they will become acquisition targets.

Based on this situation, the future of collections will accelerate through 2026-2027, with AI capability becoming a primary acquisition criterion. Firms that invested early in technology become acquirers; those that delayed become targets or casualties.

Prediction 4 — Agentic AI Moves from Notification to Negotiation

Current automation in most debt collection conversations follows rigid “if X, then send Y” rules, which reduces manual effort but doesn’t negotiate intelligently. The next phase we see is an agentic AI system that evaluates context in real-time, adapts strategy based on debtor responses, and makes decisions dynamically, all while adhering to compliance and profitability guardrails.

Imagine a debtor rejects an initial proposal; instead of waiting for human agents to intervene, agentic AI evaluates the response, updates context, and proposes a counteroffer.

This transformation will lead to a huge shift in cost-per-dollar economics. Banks and financial institutions report a 77% ROI on agent deployments as risk checks, fraud detection, and operations increasingly run without human delays.

Future debt collection strategies in 2026 will require agentic AI negotiation in AI collections platforms. Those still relying on scripted decision trees will face measurable performance gaps.

Prediction 5 — Offshore Operations Face Structural Decline

Many financial companies today use overseas call centers because it’s cheaper to hire people there. The FCC’s foreign call identification rule requires incoming calls from outside the U.S. to display a visible indicator showing foreign origin. But the problem is that when borrowers see a “foreign” label, they’re even less likely to answer because they associate it with scam calls.

If no one answers the phone, it doesn’t matter how cheap the agent is.

So instead of hiring offshore teams that people don’t answer to, companies will leverage AI-powered voice calls that immediately disclose at the start of the call that the recipient is speaking to an AI agent, state the company’s name, and explain the purpose of the call. This will lead to a high contact rate.

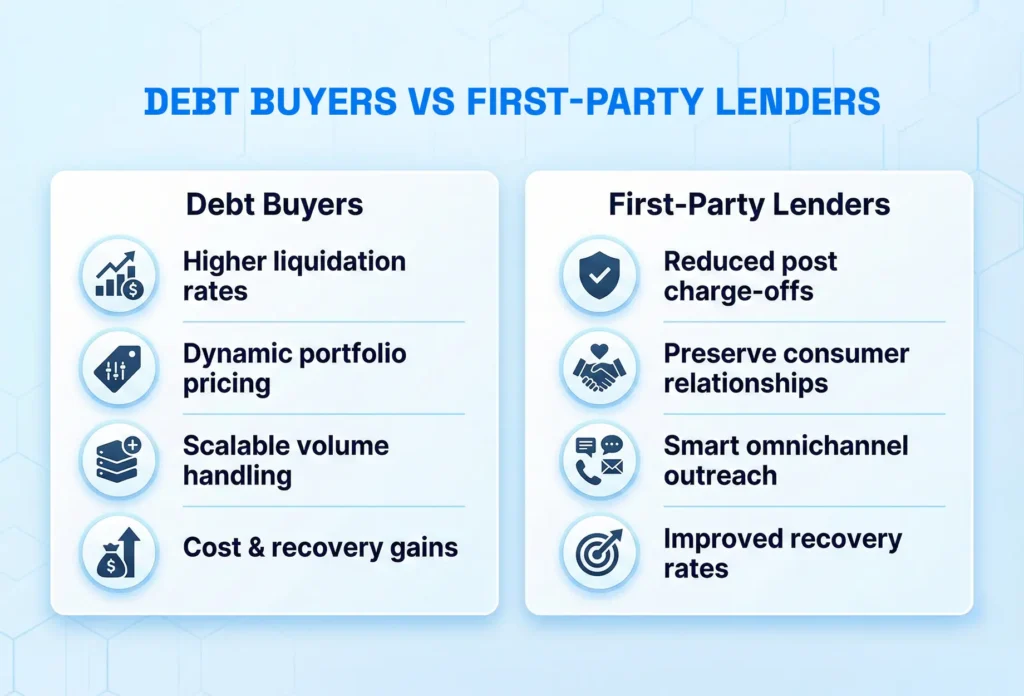

What This Means for Debt Buyers vs. First-Party Lenders

The same AI capabilities we discussed serve different and specialized roles for first-party lenders and debt buyers, driven by their distinct objectives.

Implications for Debt Buyers

Debt buyers care about liquidation curves, cost per dollar collected, portfolio yield, and scale.

- AI increases the liquidation rates by calculating propensity-to-pay scores based on real-time data so that debt buyers can prioritize high-probability accounts and tailor their engagement strategies.

- AI-enabled predictive modeling improves accuracy in pricing portfolios by monitoring real-time market conditions and dynamically adjusting portfolio pricing.

- Volume fluctuations are inherent to debt buying (portfolio acquisitions, seasonal patterns, economic cycles). AI automation tools like Kompato AI can handle 10x volume without proportional cost increases.

- According to McKinsey, AI reduces operational costs by up to 40%, increases recoveries by 10%, and boosts customer satisfaction scores by as much as 30%.

Implications for First-Party Lenders

First-party lenders prioritize pre-charge-off effectiveness, brand protection, customer retention, and the dual mandate of recovering debt while preserving relationships.

- AI offers a proactive approach to reduce post-charge-off in the first place by early intervention based on the customer’s real-time financial data.

- Instead of applying aggressive recovery techniques, AI can offer tailored payment plans that consumers can realistically complete to preserve long-term customer relationships.

- AI orchestrates intelligent outreach across SMS, call, email, and portal while preserving band consistency and context from past interactions. Consumers are contacted at the right time, right channel, and with a personalized message for maximum recovery rates.

The Honest AI Limitations in Collections

While AI offers many advantages yet comes with its own set of limitations because of collection technology challenges. That’s why it’s never meant to replace humans. The goal is to let AI handle 70-80% of routine interactions so humans can focus on the 20-30% requiring judgment, empathy, and complex problem-solving.

- When a consumer is going through genuine financial stress like losing a job, a medical emergency, or a family crisis, AI can recognize and escalate the case, but cannot provide the required level of judgment and empathy.

- Similarly, sensitive disputes involving documentation review, investigation of account history, or conflicting information require a human collector’s analysis.

- AI can flag anomalies, fraud, or identity theft, but only acts as a decision support system, not as an autonomous, accountable, or truly ethical agent. The final decision is taken by human collectors.

- AI performs well on patterns it has seen during training. However, novel situations may require human intervention until AI learns the new patterns.

- AI systems can detect a consumer’s stress or frustration level, but then escalate it to humans to handle the situation. Because human de-escalation skills are irreplaceable.

The limitation isn’t AI capability; it’s appropriate deployment. Organizations that position AI as handling 100% of interactions will fail. Those who design for intelligent human-AI collaboration will succeed.

That’s why Kompato’s design philosophy revolves around “Human-Centric AI & Fusion with Humans” to assist human agents rather than replacing them.

Kompato AI: Future Ready AI Debt Collection

At Kompato, we carefully analyzed all the contemporary challenges in the debt collection industry and designed Kompato AI that addresses all those with high accuracy, while adhering to all regulatory compliance at scale. Our AI agents at Kompato AI deliver on what the market demands today and in the upcoming years!

- Kompato addresses labor economic challenges through instant scalability with a 40–60% cost reduction compared with traditional methods.

- All regulatory requirements(FDCPA, TCPA, and Regulation F) are hard-coded in our system and enforced in real time across all interactions and touchpoints. Our compliance report shows 99.91% pass rate across 45 regulatory and internal policies.

- Kompato powers AI phone calls with real-time scoring and adaptive negotiation with profitability guardrails and compliance. Plus, our two-way AI-powered texting and email are coordinated intelligently at the right time across the right channels. Our AI agents resolve 96.4% of queries, leaving only 3.6% of live voice calls escalated to human agents.

- For a bifurcated consumer base, our tool offers personalized payment plans with intelligent routing based on debtor behavior, segment, and geography.

- Kompato AI served both first-party lenders to recover pre-charge-off accounts as well as third-party debt buyers for post-charge-off recovery, each with maximum recovery targets. We’ve driven liquidation rates 20% higher than those of peer agencies within three months.

For organizations evaluating AI collections platforms, Kompato offers a rapid path to deployment with all the above mentioned features already developed to meet the 2026-2027 landscape demands. Schedule a demo today!

How should you Position Your Operations for 2027

Forward-thinking financial institutions should prepare themselves for AI collections implementation that aligns future debt collection strategies in 2027. We recommend starting by evaluating how their current collection operations are performing and where AI can add value.

For that, we recommend the following assessment priorities:

- Audit current channel performance by geography and segment: Segment your strongest and weakest recovery rates across demographics. Assess segments response rates for each channel. Analyze performance in high-delinquency vs. low-delinquency regions.

- Identify highest-volume routine interactions for AI prioritization: Target high volume, low complexity, immediate ROI workflows like payment reminders, balance inquiries, and standard payment arrangements.

- Establish baseline metrics before any transition: Define KPIs before AI collections implementation to measure performance like cost per dollar collected, promise-to-pay conversion rates, compliance exception rates, and channel-specific response rates.

- Define compliance review cadence for AI governance: Identify who will review AI interactions for compliance? How often are scripts and decision trees audited? What escalation triggers are in place?

- Evaluate platforms against 2026-2027 requirements: Assess if your AI collections implementation is truly omnichannel (with contextual memory) or just a siloed multi-channel. Can your Agentic AI handle negotiations or just provide scripted responses? Is your compliance architecture built-in or bolted-on? Finally, identify if your platform demands linear vs non-linear cost scaling with volume.

Final Thoughts on the Future of AI in Debt Collections

Based on current signals, we see a high AI adoption rate in the future of the debt collection industry as it’s the only key to solving the variety of today’s challenges, like elevated delinquency rates, labor constraints, regulatory complexity, and consumer expectations. Strongest performers will go beyond surface-level automation and leverage AI as an operational backbone across departments. They will combine AI capabilities with operational redesign, geographic strategy, and continuous compliance adaptation. The Jefferson Capital IPO $1.2B valuation, 40%+ margins, 85% collections growth demonstrates what’s possible. That becomes the benchmark against which all operations are measured.

Frequently Asked Questions

Costs depend on scope, data volume, features, hosting, and level of automation. Normally, it ranges from $100,000–$650,000.

Yes. Modern AI collection platforms are designed to integrate with legacy systems such as CRMs, dialers, and payment platforms using APIs or middleware without disrupting their existing infrastructure.

Consumers tend to respond better to AI-driven outreach because it’s more personalized according to their tone, timing, channel, and situations.

Organizations should consolidate and clean historical account data like payment patterns, contact attempts, and basic customer profiles from CRM systems, payment processors, and communication channels to create a 360-degree view of the debtor.

Other KPIs include contact efficiency, hours saved, promise-to-pay adherence, dispute resolution speed, compliance risk reduction, agent productivity, and consumer satisfaction.

Regulators in the US (CFPB) perceive AI as a mix of a handy tool that can significantly enhance ROI while staying competitive, but at the same time, a high-risk tool that must not violate existing consumer protection laws (e.g., FDCPA, TCPA).

It normally takes between 30 and 90 days for standard engagements and can even extend to 3-6 months or more for complex, highly regulated financial institutions.